Wealth Management

Looking Forward Toward Your Future…

While many advisors and advisory companies are mainly focused on investments, Finestone Financial is concentrated on our total financial relationship with our clients. We provide a wealth management experience that addresses the entire range of your financial concerns, not just investments, within the context of a long-term relationship. We do not take on new wealth management clients unless we can add significant value to our client’s lives.

Managing your wealth means balancing a wide array of concerns:

Growing Your Wealth

Wealth preservation. Wealth preservation is not just about not losing money. It is about having enough money to fund your lifestyle and to be able to do what you want to do, whether that is simply to retire securely and pay for their children’s education or to take care of multiple homes or buy a boat.

The way to achieve this is through astute investment management that produces optimal returns consistent with your time frame and tolerance for risk. Thus, wealth preservation is a primary area of focus.

Managing Risk And Reducing Taxes

Wealth enhancement. The goal of wealth enhancement is to minimize the tax impact on your investment returns while ensuring the cash flow you need.

Taking Care Of Your Loved Ones

Wealth transfer. This is about finding and facilitating the most tax efficient way to pass assets to a spouse and succeeding generations in ways that meet your wishes by planning for the eventual transfer of your estate or the succession of your business.

Protecting Your Assets From Being Unjustly Taken

Wealth protection. This includes all concerns about protecting wealth against catastrophic loss from potential creditors, litigants, children’s spouses and potential ex-spouses, and identity thieves.

Making Your Charitable Concerns Count By Efficiently Leaving The Legacy You Desire

Charitable giving. This encompasses all issues related to fulfilling the client’s charitable goals in the most impactful way possible. It can often support efforts in other areas of concern.

OUR WEALTH MANAGEMENT PROCESS

WE OFFER AN UNBIASED OBJECTIVE ASSESSMENT OF YOUR CURRENT WEALTH MANAGEMENT STRATEGY

Many of our clients report that some of the most significant people in their lives share concerns about…

- Protecting against potential creditors and litigants

- Fulfilling their charitable intent

- Preserving and growing wealth

- Mitigating taxes

- Ensuring their heirs are well cared for

…and question whether their current financial and investment plan effectively addresses these concerns.

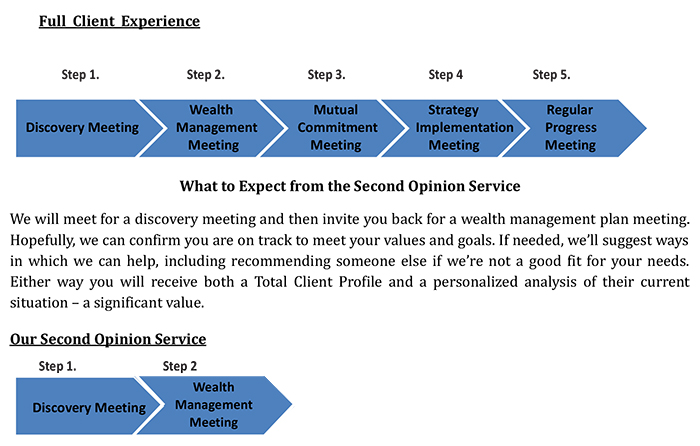

Our Second Opinion Service provides an objective assessment of your current plan’s ability to alleviate your concerns, achieve your objectives and provide peace of mind.

SECOND OPINION SERVICE

WHY IS A SECOND OPINION IMPORTANT?

Much like a patient might seek out a second opinion after a medical diagnosis, our S.O.S. can provide tremendous peace of mind as we work with you to determine if your current investment and financial plan is designed to achieve your objectives, protect your dignity and maintain your independence for life.

Our process provides an opportunity to take appropriate action now to avoid the consequences of inaction in the future.

AM I GETTING PRUDENT FINANCIAL ADVICE?

Financial advice is often obtained from advisors who work in silos without the necessary help and knowledge of a proficient, professional network.

Today’s rapidly changing and volatile investment, political and economic environments require wealth management from investment fiduciaries working with a team of competent tax, legal and insurance professionals. Our Second Opinion Service and Wealth Management Consultative Process provide just that.

HOW DO I REQUEST A SECOND OPINION?

To Request a Second Opinion, call or email us today.